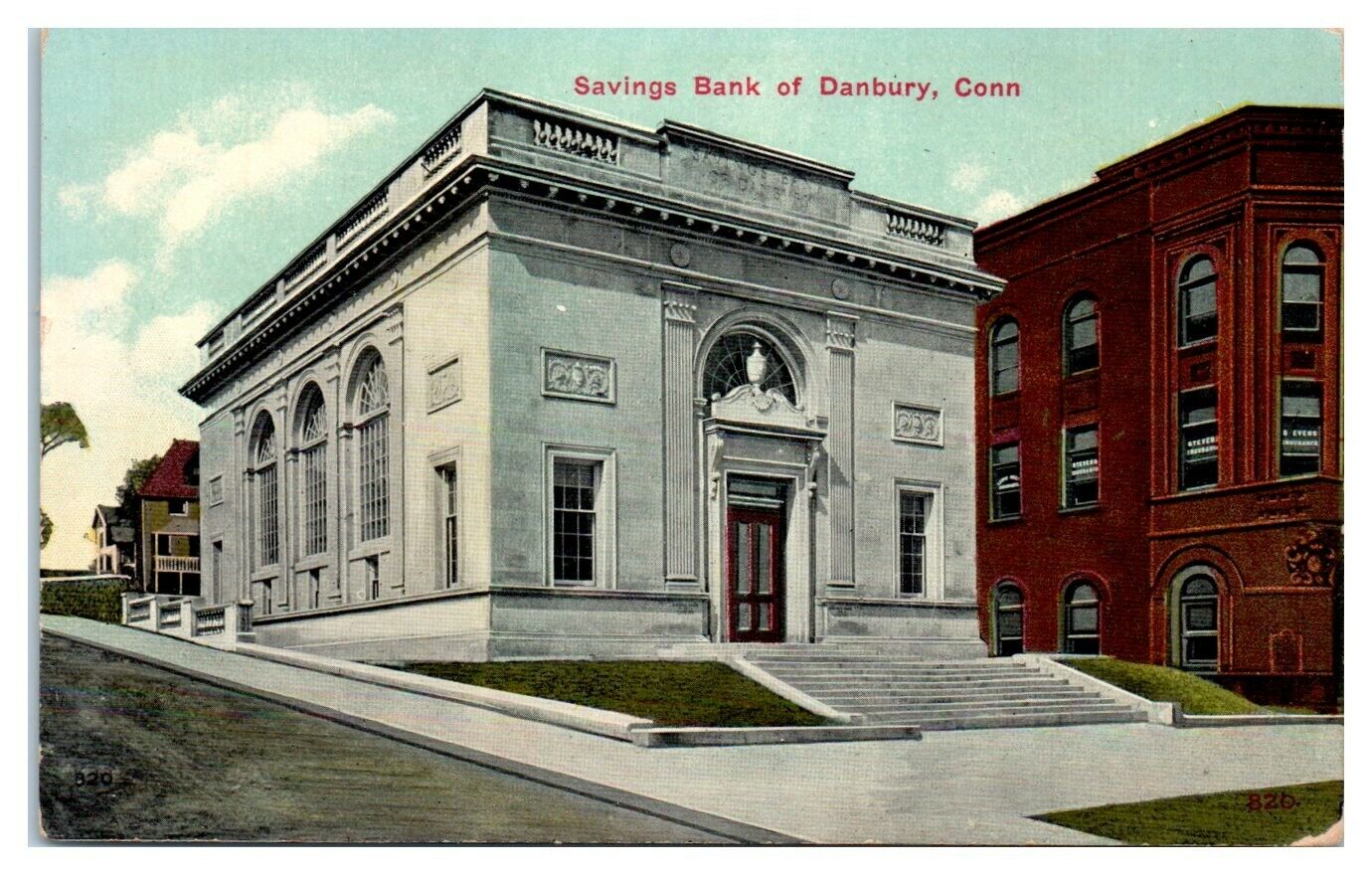

The Savings bank of Danbury: A Deep Dive

The Savings Bank of Danbury, a cornerstone of the Connecticut financial landscape, boasts a rich history intertwined with the growth and development of the region. Founded in 1849, the bank has evolved from its humble beginnings to become a prominent financial institution serving the needs of individuals, families, and businesses throughout the state.

This article will delve into the key aspects of the Savings Bank of Danbury, exploring its history, services, community involvement, and financial performance.

Founding and Early Years

The Savings Bank of Danbury traces its roots back to 1849 when it was established as a mutual savings bank with a mission to provide a safe and secure place for individuals to save their hard-earned money. In those early days, the bank primarily focused on offering basic savings accounts and supporting the local community through modest loans.

Growth and Expansion

Over the decades, the Savings Bank of Danbury experienced steady growth, expanding its services to meet the evolving financial needs of its customers. This included the introduction of checking accounts, mortgages, and other loan products. The bank also gradually expanded its geographic reach, opening branches in key locations throughout Connecticut.

Navigating the Modern Era

In recent years, the Savings Bank of Danbury has embraced technological advancements, implementing online and mobile banking platforms to enhance customer convenience and accessibility. The bank has also actively sought to adapt to the changing regulatory environment and remain competitive in the evolving financial services market.

Personal Banking

The Savings Bank of Danbury offers a comprehensive suite of personal banking services, including:

Checking and Savings Accounts: A variety of checking and savings accounts to suit different needs and financial goals, with competitive interest rates and convenient features.

Business Banking

The bank provides a range of business banking solutions tailored to meet the specific needs of small and medium-sized enterprises (SMEs), such as:

Business Checking and Savings Accounts: Business checking and savings accounts with features such as remote deposit capture and treasury management services.

Other Services

The Savings Bank of Danbury also offers a variety of other financial services, including:

Investment Services: Investment and wealth management services to help customers achieve their long-term financial goals.

The Savings Bank of Danbury has a long-standing commitment to supporting the communities it serves. The bank actively engages in various philanthropic activities, including:

Charitable Donations: Supporting local non-profit organizations through charitable donations and sponsorships.

The Savings Bank of Danbury has consistently demonstrated strong financial performance, reflecting its sound business practices and commitment to customer satisfaction. The bank has maintained a strong capital position and has consistently generated positive earnings.

The Savings Bank of Danbury has a rich history and a strong reputation for providing exceptional customer service and supporting the communities it serves. With its commitment to innovation, community engagement, and financial strength, the bank is well-positioned to continue serving the needs of its customers for many years to come.

This article is for informational purposes only and should not be construed as financial advice. The information provided may not be accurate, complete, or current. Please consult with a qualified financial advisor for personalized guidance.

This article provides a general overview of the Savings Bank of Danbury. Specific products, services, and terms may vary. Please refer to the official website or contact the bank directly for the most up-to-date information.