Cash Management Solutions for banks in 2025

Cash management is a critical function for banks, enabling them to optimize liquidity, manage risk, and maximize profitability. In today’s dynamic financial landscape, banks face numerous challenges, including evolving customer expectations, increasing regulatory scrutiny, and the rise of fintech disruptors. To stay competitive, banks must adopt innovative cash management solutions that streamline operations, enhance customer experience, and drive efficiency.

What is Cash Management?

Cash management encompasses the strategies and processes banks use to manage the flow of cash both into and out of their institutions. It involves optimizing liquidity, minimizing risk, and maximizing the return on cash assets. Effective cash management is essential for banks to meet their financial obligations, maintain regulatory compliance, and support their overall business objectives.

Key Components of Cash Management

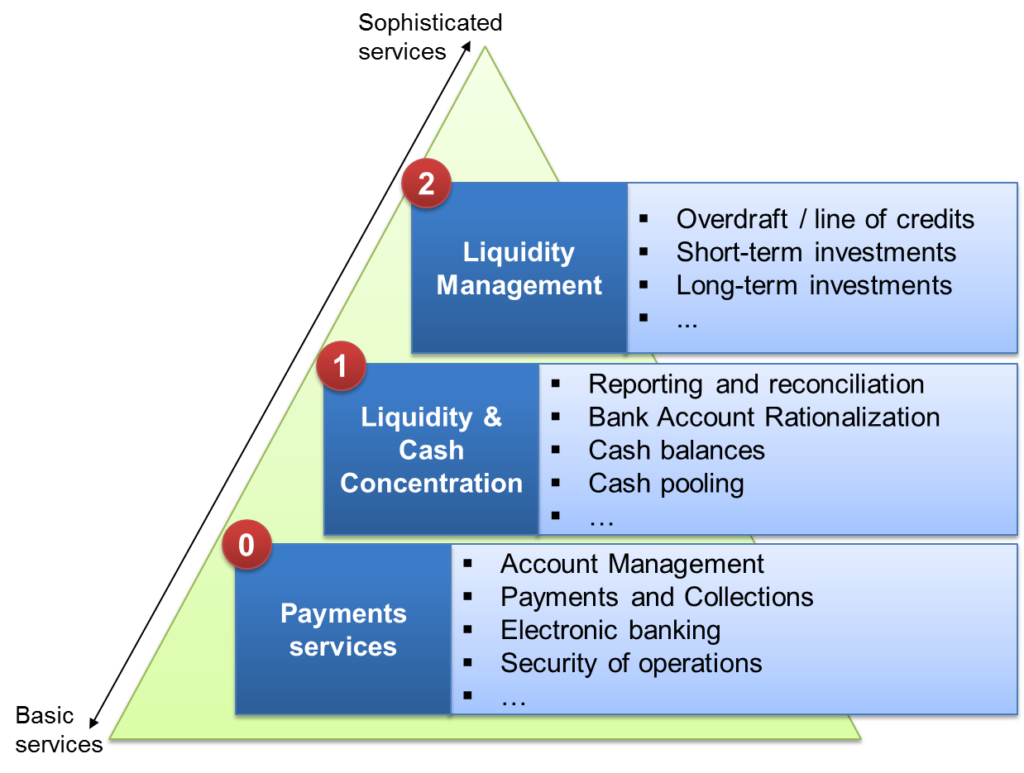

Effective cash management involves several key components:

Liquidity Management

Liquidity management ensures that banks have sufficient cash on hand to meet their short-term obligations, such as paying depositors and clearing transactions. It involves forecasting cash flows, managing funding sources, and maintaining a portfolio of liquid assets.

Cash Flow Forecasting

Accurate cash flow forecasting is essential for anticipating future cash needs and ensuring that banks have adequate liquidity. It involves analyzing historical data, projecting future inflows and outflows, and considering various economic and market factors.

Working Capital Management

Working capital management focuses on optimizing the efficiency of day-to-day operations, such as managing accounts receivable and payable. It involves streamlining processes, automating tasks, and leveraging technology to improve cash flow.

Risk Management

Risk management involves identifying and mitigating potential risks related to cash management, such as fraud, errors, and market volatility. It includes implementing robust controls, monitoring transactions, and diversifying funding sources.

Investment Management

Investment management focuses on maximizing the return on cash assets while maintaining appropriate levels of liquidity and risk. It involves investing in a diversified portfolio of short-term, low-risk securities.

Challenges in Cash Management

Banks face several challenges in managing cash effectively:

Evolving Customer Expectations

Customers expect seamless, real-time access to their funds and innovative cash management solutions. Banks must invest in technology and digital platforms to meet these evolving expectations.

Regulatory Scrutiny

Banks are subject to increasing regulatory scrutiny, particularly regarding liquidity and risk management. They must ensure compliance with various regulations, such as Basel III, which can be complex and costly.

Fintech Disruption

Fintech companies are disrupting traditional banking models by offering innovative cash management solutions. Banks must adapt and innovate to remain competitive.

Economic Uncertainty

Global economic uncertainty can impact cash flows and create challenges for forecasting and liquidity management. Banks must be prepared to navigate these uncertainties.

Cash Management Solutions for Banks

To address these challenges, banks are adopting various cash management solutions:

Real-Time Payments

Real-time payments enable instant fund transfers, improving cash flow and efficiency. Banks are implementing real-time payment systems to meet customer demand and stay competitive.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are being used to automate tasks, improve cash flow forecasting, and enhance risk management. These technologies can analyze vast amounts of data to identify patterns and insights that can inform cash management decisions.

Cloud Computing

Cloud computing offers scalability, flexibility, and cost-effectiveness for cash management systems. Banks are migrating their cash management platforms to the cloud to improve efficiency and reduce costs.

Blockchain Technology

Blockchain technology can streamline cross-border payments and improve transparency in cash management. Banks are exploring the use of blockchain to enhance efficiency and reduce costs in international transactions.

Mobile Banking

Mobile banking provides customers with convenient access to cash management services, such as balance inquiries, fund transfers, and bill payments. Banks are investing in mobile platforms to enhance customer experience and drive adoption.

Open Banking

Open banking allows third-party providers to access bank data and offer innovative cash management solutions. Banks are partnering with fintech companies to leverage open banking and expand their service offerings.

Benefits of Effective Cash Management

Effective cash management provides numerous benefits for banks:

Improved Liquidity

Optimized cash management ensures that banks have sufficient liquidity to meet their obligations and withstand unexpected events.

Reduced Risk

Robust risk management practices mitigate potential risks related to cash management, such as fraud and errors.

Increased Profitability

Efficient cash management can maximize the return on cash assets and improve overall profitability.

Enhanced Customer Experience

Innovative cash management solutions can enhance customer experience and drive loyalty.

Competitive Advantage

Banks with advanced cash management capabilities gain a competitive advantage in the marketplace.

Conclusion

Cash management is a critical function for banks in 2025. By adopting innovative solutions and embracing technology, banks can optimize liquidity, manage risk, and enhance customer experience. As the financial landscape continues to evolve, banks must prioritize cash management to ensure their long-term success.